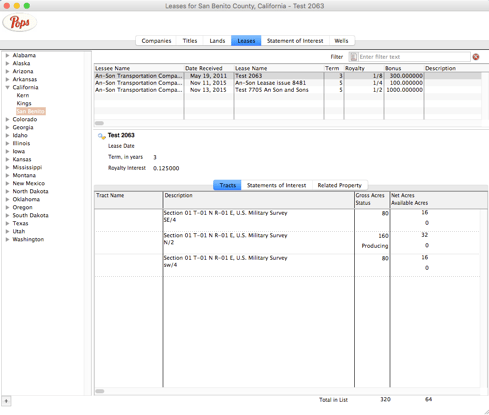

The Leases Viewer shown here in Figure 3-1 provides a central location for viewing and managing your leases and lease offers.

Fig 3-1 The Lease Viewer

The top of the lease viewer displays information for the state and/or county category selected in the Navigator. Information displayed from left to right includes: 1) Lessee Name (company name of tenant); 2) Date Offer Received (date the lease offer was received); 3) Lease Name (legal name referenced in the lease agreement); 4) Term (duration of the lease expressed in years); 5) Royalty (funds received from oil/gas/mineral production expressed as a fractional interest rate); 6) Bonus (cash consideration sometimes paid upon execution of the lease agreement expressed as a decimal value); and 7) Description (comments pertinent to this lease agreement).

To add a new lease into POPS, click the plus sign located at the very bottom left of the window. The Lease Detail window will automatically open in modify/edit mode.

To view a specific lease’s data in greater detail double click the lease row. You can also single click the lease row record, and then click the View Lease Detail icon button. You will notice that the Leases Viewer window title updates to this newly selected lease indicating that it is now the “active” record.

TIP: To quickly locate a lease record from within the selected State and County, you can enter its Lessee Name, Date Received or Lease Name into the Find box located on the Viewer Menu Bar then click the magnifier icon. First matching record will be highlighted in the data grid.

Working with Lease Detail

The Lease Detail window is a centralized location for viewing and editing lease information to include terms; land tracts specified in the lease and related properties (other land tracts). It provides an in depth view of your oil, gas and/or mineral lease. (The lease agreement outlines the basic terms underlying the development and use of lands or minerals such as the royalty to be paid, duration, and description of the land(s) involved.)

You can access the Lease Detail for a specific lease by double clicking the desired Lessee name. The window will open as view only. To make changes, simply click the modify button. If you wish to undo the changes you made, click cancel. When finished making changes, click save.

AUTO FEATURE: The location field (County and State) has a built-in auto-fill feature. You can type in the first few letters of a county name and POPS will suggest the closest match. If the suggestion is incorrect simply continue typing letters until the desired “County, State” match appears.

Pops’ five stages of a lease life.

- Offer Received (date of the lease offer);

- Signed & Returned (date the lease agreement is accepted);

- Arrival of Division Order (date the schedule of owners and revenue shares arrives);

- Rental Paid (date the lease payments have been deemed paid-up); 5) Held by Production (date the HBP clause executes, that is production has begun and continues to be commercially viable).

The ‘Status’ section (the bottom left of lease detail window) contains date specifics indicating where in the process flow a lease currently resides. There is a vertical ‘progress bar’ which provides an at-a-glance- view of where the lease resides in the process.

The ‘Terms’ section (positioned in the middle) of the lease detail window contains the basic terms of the oil, gas or mineral lease to include: 1) Term of lease (duration of lease expressed in years or the amount of time a company has to “establish commercial production or production of oil/gas in paying quantities”); 2) Lease rental per acre (expressed in currency format e.g. $0.00); 3) Bonus per acre (cash consideration per “net (mineral) acre” paid upon the execution/signing of an oil, gas or mineral lease expressed in currency format) if applicable; 4) Net Acres (a calculated/derived value of the subsurface mineral acreage you own where Net Acres = Interest in Gross Acres x Total Surface Acres); 5) Royalty Fractional Interest; and 6) Royalty Decimal Interest.

NOTE: For the purposes of POPS? the term “royalty interest” is used broadly to include “mineral interest”, “royalty interest” and “overriding royalty interest”. However in strict industry parlance these terms are different. Both the owner of a mineral interest and a royalty interest own rights to the minerals/oil/gas underground. The owner of a mineral interest has the right to execute leases and receive up-front (at signing) bonus payments whereas the owner of royalty interest does not. The owner of an overriding royalty interest does not own any rights to minerals/oil/gas underground, but to a portion of the production proceeds. The owner of an overriding royalty interest retains no ownership rights at the end of the lease term.

The ”Nature of Materials” section (located towards upper right of details window) describes the nature of the material for which the lease is executed. You may check one or multiple checkboxes as they apply. Material types include: Gas, Oil, Natural Gas, Condensates, Coal and Other Minerals (i.e. not coal).

Land Tracts

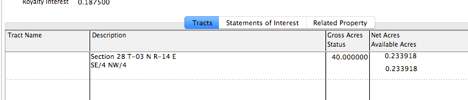

Fig 3-3 Land Tracts

The Land Tracts window conveniently displays the land tract(s) information associated with the selected lease record to include from left to right: 1) Tract Name; 2) Description (legal description of the land); 3) Gross Acres Status and 4) Net Acreage (acreage under contract which is a calculated/derived value of the subsurface mineral acreage you own where Net Acres = Interest in Gross Acres x Total Surface Acres under contract).

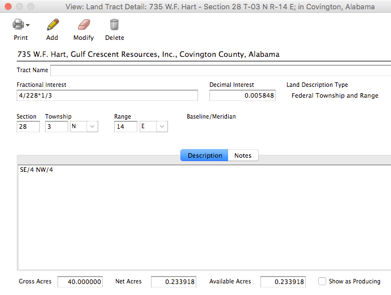

Working with Land Tracts Detail

To access the land tract detail window simply double click the desired land tract record. POPS will take you to the Land Tract Detail window where you can view further details or edit the land tract record. See Chapter 6, “Working with Land Tract Detail” for more information.

3-4 Land Tract Details

NOTE: From the standpoint of searching out potential land tracts that could be leased for production, it is necessary for Pops to designate all existing land tracts as either “producing” or “non-producing”. A land tract is flagged as “producing” if it has a well on it (or a well that draws from it) whose “well status” is set at “producing”. In contrast a land tract is flagged as “non-producing” if it has either a) no producing well on it or b) it has a well on it whose “well status” is “shut-in”, “dry hole” or “plugged and abandoned”

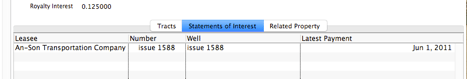

Statements of Interest

All companies who have been designated as lessee or tenant on the selected lease record are conveniently displayed here. Included here are royalty payment specifics for a lease such as: 1) Lessee (company name or tenant); 2) Number; 3) Well Name; and 4) Date Last Paid (date of the last/latest proceed/royalty payment). For more information see Chapter 4, Statements of Interest.

Fig 3-5 Statements of Interests

Related Property

POPS analyzes all land tracts in the system to locate properties (land tracts/parcels) that are “related” to the leased property. POPS considers a “related property” to be a land tract(s) whose description resembles or closely matches the leased land description. For example, the leased land may be part of one or many larger land tracts (considered the related property) described in a title or deed currently inputted into POPS?

To view the Related Property drop down menu:

- Ctrl-click (or right mouse if available) anywhere on the Related Property window.

- Click the gear widget button to display the Related Property drop down menu.

From the Related Property drop down menu you can:

- Compare the leased land tract to other land tracts described within titles;

- Modify (and view) a land tract;

- Modify (and view) the title which references a selected land tract;

- Remove selected land tract(s) from the Related Property list.

Recent Comments